Amibroker is configured on a workstation to provide live / on-the-go breakout signals

These are then processed and shared as tweets.

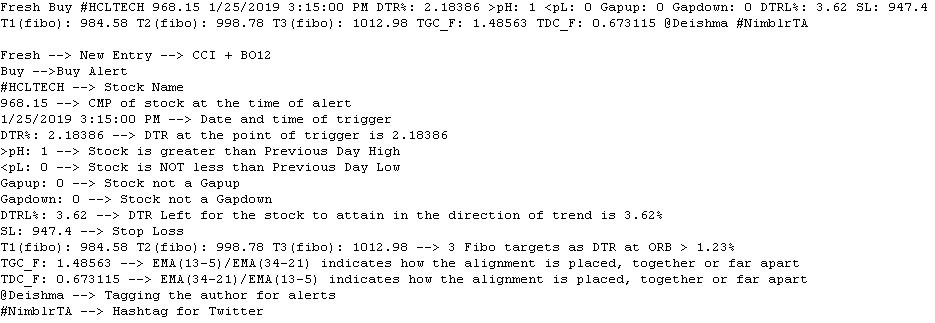

The image below is from Amibroker which runs the code to screener 50 stocks (Nifty50) and provide signals

Autotweet Example

Buy #BAJAJFINSV 4969.85 3/9/2018 3:24:59 PM DTR%: 2.96322 >pH: 1 <pL: 0 Gapup: 0 Gapdown: 0 DTRL%: 1.26678 SL: 4845 T1: 5049.94 TGC_F: 0.789819 TDC_F: 1.26611 @Deishma

TGC means that close > ema 5 > ema 21 > ema 55 and it is aligned, to identify if they have started to separate out or are still within a close range we use Triple Golden Cross Factor and Triple Death Cross factor these must not be >2 for a new trend beginning

TDC indicates close < ema 5 < ema 21 < ema 55

T1 is the target for stock for that day,

SL is the stop loss

pH and pL indicates if stock is greater than previous day high or lower than previous day low.

Gap up indicates if current day opening low is > (n-1) day closing high,

Gap down indicates if current day opening high is < (n-1) day closing low,

DTRL% is the scope of the stock move in the trending direction,

DTR current Day True Range Value at the current candle

There are 4 categories in which the analysis is configured to tweet.

1) Reversal Conditions

2) Fresh Entry Signals

3) Re-Entry Signals

4) OST Signals

Reversal Condition:

This is the most early signal to identify the reversal on the 5 minutes charts, pSAR gives even a visual signal complimenting the same.

Please refer to Intraday_Setup for the setup conditions

This gives the most lucrative results for intraday trading due to the sentiments and the euphoria with the reversals

Condition:

Buy=sum(BO2condtrue,barssince(NewDay)>0) AND BO1active==1 AND (L<pL OR pL<pL1 OR (L<pL AND pL<pL1)) AND (Cross(CC34_5m,100) OR (CC34_5m>100)) AND (EMA(Close,5)>EMA(Close,13))AND(EMA(Close,13)>EMA(Close,34)) AND (tgc_factor>0.381) AND (tgc_factor<2.22);

Condition is modified from (L<pL OR pL<pL1 OR (L<pL AND pL<pL1)) to L<pL

Reason:

Ideally if the follow up is to come it should be in the form of momentum trade next day .. other wise the rule of staying in the trade based on CCI 34 5min applies (crossing below -60)

Fresh Entry Signals

This is the basic condition where CCI crosses 100 and Strength candles are formed (BO1 and BO12) i.e. CCI+BO12 are true

Condition:

Buy=(BO1active==1) AND ((sum(BO2condtrue,barssince(NewDay))>0 AND CCI_B==1) OR (sum(CCI_B,barssince(NewDay))>0 AND BO2condtrue==1) OR (Cross(CCIB_BO12,0.99)));

Re-Entry Signals

This condition gives a better entry as compared to Fresh entry since it uses the retracement logic to identify if

- CCI34 30mins is in place

- BO1 and BO2 are formed

- BO2 may or may not be valid at the point, but BO1 must be valid

- CCI8 5mins <-100 in case of Buy signals (< -135 is best entry point) while other conditions are true.

Condition:

Buy=(CCI_B_Reentry*BO1active AND ((sum(BO2condtrue,barssince(NewDay))>0 AND CCI_B==1) OR (sum(CCI_B,barssince(NewDay))>0 AND BO2condtrue==1) OR (Cross(CCIB_BO12,0.99))));

Where:

BO1active=IIf(L<BO1Low,0,1);

BO2condtrue=IIf(BO2cond*HHcond==1 AND BO1condtrue==0,1,0);

CCI_B=IIf(Cross(CCI_34,100) OR (CCI_34>100),1,0);

CCI_B_Reentry= IIf(CCI8_5m<-100,1,0); (For Normal Retracement)

CCIB_BO12=IIf(CCI_B==1 AND BO1active==1 AND BO2condtrue==1,1,0);

For XtrmXtrm Retracement:

Buy Side: CCI8_5m<-60 AND CCI34_5m>60 AND CCI_34_30m>175

Sell Side: CCI8_5m>60 AND CCI34_5m<-60 AND CCI_34_30m<-175

Examples of XtrmXtrm Retracement as per the written logic:

Open Session Trading (OST) Signals:

The condition is checked on the completion of the first 5 minutes candle of the day with following logic:

1) CCI 34 30 mins >100

2) CCI34 5 mins >100

3) EMA Factor is in the range of 0.381 to 2.22

4) Stock crosses previous day high/low

5) 1st candle of 5 mins is a strength candle

Conditions:

Buy=tn<092000

AND barcomplete

AND ((tgc_factor>0.381 AND tgc_factor<2.22) OR (ptgc_factor>0.381 AND ptgc_factor<2.22))

AND CCI_34>100

AND CCI34_5m>100

AND pHigh=="1"

AND CheckStrengthCandle;

Sell=tn<092000

AND barcomplete

AND ((tdc_factor>0.381 AND tdc_factor<2.22) OR (ptdc_factor>0.381 AND ptdc_factor<2.22))

AND CCI_34<-100

AND CCI34_5m<-100

AND pLow=="1"

AND CheckStrengthCandle;

Example:

Reference:

https://twitter.com/Deishma/status/1096872949787881473

Entry:

Enter the trade if price crosses above

High(1st 5 mins candle)*1.00075 (add 1 to the High of the 1st 5 mins candle as a thumb rule for entry)

1764*1.00075 = 1765

Target:

Low of 5min+(Low of 5mn)*(DTRL- 0.725)*0.618%

=(1749.55) + (1749.55) * (3.23-0.725) * 0.618%

=(1749.55) + (1749.55) * 1,548%

=1776.63

Note:

In such a case the momentum last usually from 20 to 40 minutes.

Exit Condition:

EXIT Buy CCI 34 5m < -60 provided CCI 34 30M < 110 if not wait on EXIT condition

EXIT Sell CCI 34 5m >60 provided CCI 34 30M > -110 if not wait on EXIT condition ...

Backtesting Example:

The indicator for Amibroker would be available soon

To understand it's interpretation, please follow this live link: https://twitter.com/krishnakhanna/status/1102941817140625410?s=20